What is a Directors Pension?

An Executive Pension is a product designed to allow Company Directors and key employees to save for retirement while taking advantage of useful tax incentives, such as extracting wealth (cash) from the company in the most tax-efficient manner. This pension is set up on a defined contribution basis which means that the benefits on retirement depend on the size of the your fund.

The Executive Pension is setup by the limited company for the benefits of the directors and senior (key) employees under a trust, and trustees must be appointed (typically the Employer would act as the trustee). It is therefore, also safeguarded and independent of the company’s assets and its future profitability.

As a company director, you can extract excess profits from the company and turn them into personal wealth by way of the employer (company) making contributions to the Executive Pension plan on your behalf. This is one of the most tax efficient ways of providing retirement benefits for One Member Pension Arrangements, that include Company Directors, family members employed in the business, and key employees.

Who is Eligible?

With an Executive Pension, Company Directors, family members employed in the business, and key employees can contribution to the pension. Essentially, you can set up a pension for anyone employed by the company who is drawing a salary, including your spouse if they are a director.

How are contributions made to an Executive Pension?

Both you and your employer can contribute into your pension. This can be done on a regular contribution basis, i.e. every month, or single contribution lump sums can be made when required – and if needed, before the company year end. All contributions are invested in funds with the aim of growing your savings for retirement.

I am a Sole Trader, would it benefit me to change to a Limited Company?

In practice, there are often cases where Sole Traders can become eligible for an Executive Pension by simply “incorporating” their activities (re-registering their company type); for example John Smith the engineer becomes John Smith Engineering Limited.

Before changing, the first thing you should consider is the amount of income you are earning. As a successful business owner you are now at the point where your business is growing rapidly. At this point you may find that your tax bill is starting to pile up and you are looking for solutions to reduce your tax and maximize your wealth.

If your income reaches the higher level of income tax threshold it will then make sense to take advantage of the useful tax benefits available through a company pension. This would be one solution for incorporating your business (refer to below benefits).

What are the advantages of an Executive Pension over a Personal Pension?

1. Company Directors often use Executive Pensions over Personal Pensions as the tax benefits are more attractive. For example, contributions made through the employer are far less restricted by age related limits than with member or employee contributions, and instead are related to the cost of providing retirement benefits based on “two thirds” of salary (where there is at least 10 years’ service at retirement). So, the scope for tax-deductible contributions are higher, and there is potential for a broader scope for tax free cash at retirement.

2. You can claim the benefit of your Executive Pension from the age of 50 rather than age 60 in Personal Pensions.

3. An Executive Pension also allows you as a Director to ring-fence company money in your own name and away from the business.

Tax Benefits for Employers (Company Contributions)

This type of pension arrangement is very popular with business owners as it allows a higher degree of flexibility when it comes to employer contributions. While both employee and employer contributions limits are governed by Revenue rules, employers have the potential to make higher contributions.

When the company makes regular annual contributions to the plan on your behalf, they are not subject to a benefit-in-kind charge in your hands for income tax purposes (meaning that you will not have to pay Income tax, USC or PRSI on the company’s contributions to your plan). Here, the company is allowed to record the pension contribution as a company expense, which will help reduce the company’s Corporation Tax liability (the company gets tax relief on its contribution at the corporation tax rate of 12.5%).

How much can a Company contribute to a Directors Pension in Ireland?

As a Company Director, Revenue allows you to build up a pension fund which will provide a Director with a pension of two thirds of the final pensionable salary.

The employer can contribute as much as is needed to provide the maximum benefits allowed by Revenue at retirement, however, for tax purposes, the maximum pension fund allowed is €2 million (Standard Fund Threshold). If your pension fund exceeds this amount at retirement, you will have to pay tax at the higher rate of income tax on the excess, in addition to the tax you would normally pay on your retirement benefits.

As a Company Director, the tax benefits are more attractive, and the scope for tax-deductible contributions much higher when made by the company than if you were to make personal contributions (As you are limited to the normal revenue rules which relate to age and percentage of salary, E.g., if you are age 40 its 25% of your salary).

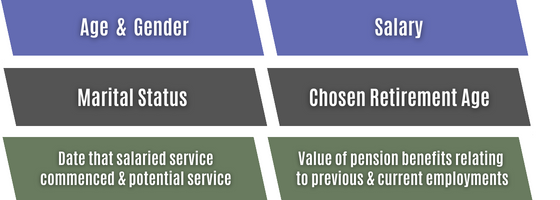

When it comes to the company making the contribution on your behalf, there are a range of factors in determining how much can be contributed.

These are based on your:

Turning Company Profits into Personal Wealth

If you take profits from the company to increase salary/bonuses or take share dividends there will be an immediate personal tax liability at your higher income tax rate!

Instead, one of the most attractive and tax-efficient ways to extract profits from the company and turn them into personal wealth is to transfer those profits into a company pension when funded by Employer contributions.

The employer/company can make a far greater contribution than the Director could make personally under the ‘personal age-related limits’, and build up a pension fund that will provide the Director with a pension of 2/3rds of the final pensionable salary.

This can be achieved through either an Ordinary Annual Contribution or Special Contributions. The maximum allowable ordinary annual contributions to a scheme include all Employer, Employee and Additional Voluntary Contributions (AVC’s) made to the scheme in the company accounting period.

Investment Options

When setting up your executive pension there are a variety of fund options available to choose from within the product, including low, medium, and high-risk options that will enjoy tax free investment growth.

Usually with pensions, it is considered more sensible to invest on a medium or high-risk basis when you are a long way from retirement (e.g., higher equity allocation) which gives greater possibility of return in the earlier years, and subsequently when approaching retirement, to look at reducing exposure to volatility in the markets by de-risking the investment into lower to medium risk funds.

When putting together a plan we will ensure the Risk Profile of pension fund is aligned with the investor’s attitude to risk.

Benefits at Retirement

What benefits are you entitled to at Normal Retirement Age?

At your Normal Retirement Age (NRA) the cash value of your accumulated fund will provide you with a range of retirement benefits, subject to the overall limits set by the Revenue. The cash value of your accumulated fund at that time will depend on factors such as the level of contributions made and the performance of the investments chosen over the term of your pension.

Retirement benefits available at your NRA are as follows:

Annuity Income:

You have the option to purchase an annuity in the form of guaranteed income (pension). This is an option that will pay you an income for as long as you live. The amount of income payable to you will depend on the annuity rates available in respect of your age at your NRA. Annuity rates are subject to a number of factors including interest rates and the type of pension chosen.

The maximum pension you can receive is two thirds of your final salary provided you have completed ten years’ continuous service at your NRA. For lower service lengths, lower Revenue limits apply. Your pension can be guaranteed for a maximum of ten years, even if you die, and/or the pension payments can be increased annually at a particular rate of interest.

Approved Retirement Fund:

At retirement, instead of having an annuity purchased for you by the Trustees (as above), you will have the option to transfer part or all of your retirement fund to an ARF. Your retirement benefit options at NRA, one or more of which will be available to you, are detailed below. The decision on which options you require does not have to be made until your NRA so this allows you to tailor the benefits to suit your needs at that time.

Spouse’s Pension:

If applicable, and in the event of your death during retirement, a pension will be payable to your spouse (for life). The maximum pension your spouse will receive is two thirds of your final taxable earnings, provided you have completed ten years’ continuous service at your NRA.

Retirement Lump Sum:

Subject to Revenue limits, your retirement lump sum could be up to one and a half times your final remuneration at NRA, assuming you have completed 20 years’ continuous service at your NRA. If you have a shorter period of service a reduced maximum lump sum applies.

By opting for a tax-free lump sum you will be reducing the level of your pension income on a pro-rata basis. If you opt for an Approved Retirement Fund (ARF), up to 25% of the accumulated fund is available to you as a retirement lump sum.

To summarize, you are entitled to the take benefits in one of two ways:

Option 1:

– A once-off lump sum of up to one and a half times final salary*; and,

– The balance of the fund must be used to purchase an annuity.

Option 2:

– A once-off lump sum of up to 25% of the value of the assets*; and,

– The balance of the fund must be transferred to an Approved Retirement Fund (‘ARF’).

Maximum Retirement Lump Sum:

The taxation of the Retirement Lump Sum benefits is as follows:

– Up to €200,000 = Tax free.

– From €200,000 to €500,000 = Standard rate (currently 20%) no reliefs and no credits allowed.

– Over €500,000 = Marginal rate (taxed under PAYE system, plus USC and PRSI).

Max Pension Illustration:

If you have a pension of €2 million, and you opt to take your Lump Sum of up to 25%:

– €2,000,000 x 25% = €500,000.

– €500,000 – €200,000 (tax free) = €300,000.

– €300,000 x 20% = €60,000 taxable.

– Therefore: €500,000 – €60,000 = €440,000 (Total available lump sum).

Do I have the option to Retire Early?

Normally, you can start taking your benefits from age 60. You may elect to retire prior to your Normal Retirement Age (NRA), where you can take early retirement from age 50 onwards. This is subject to the Revenue requirements and, where applicable, the consent of the Trustees and/or your employer. You can also retire at any age on ill-health grounds and take your benefits immediately.

If you wish to defer your retirement from the Scheme until after your NRA, you may do so up until the age of 70, provided you are still in the service of your employer. In this event, contributions to the Scheme can either be continued or ceased. In this scenario you have the option of converting part of your pension to a tax-free lump sum at your NRA and deferring the remainder of your pension until you actually retire.

The cash value of your accumulated fund and the size of the pension on early retirement will be less than if you had continued to your NRA for several significant reasons:

1. The contributions made to the Scheme will be invested for a shorter period than expected.

2. The potential number of contributions to the Scheme is reduced.

3. The cost of providing your pension will be higher as it will be payable for a longer period than

expected.

Benefits on Death

What happens to my benefits if I die before Retirement?

Death-in-Service:

1: The cash value of your accumulated fund at the date of your death will be available to provide death-in-service benefits. The maximum allowable death-in-service lump sum is the greater of €6,350 or four times your final remuneration.

This lump sum must be reduced by any retained benefits (lump sums payable from previous employments, if applicable to you) except in cases where the death-in-service lump sum being paid is equal to or lesser than two times final remuneration.

2: The Scheme Trustees must then arrange for either an Annuity or an ARF for your spouse or dependents (where applicable) with any remaining funds.

Death after leaving Service:

Where you have left service and are entitled to a deferred benefit, the cash value of your accumulated fund at the date of your death will be made payable to your estate.

Executive Income Protection

If you are looking to protect the ongoing operations of your company, Executive Income Protection is a good way of providing income security for Directors or key employees. This plan differs from personal income protection policies in that an Executive policy is owned by the company the insured works for, rather than the individual themselves.

In the event of not being able to work the insured employee is then covered, with the pay-out being made to the company directly. You can then decide if the money is to be used to:

- Cover the cost of a key employee or;

- Be paid to the employee themselves.

This benefit paid by the company is not seen as a benefit-in-kind which means it is very tax efficient way of providing cover. An Executive Income Protection Policy is therefore a very attractive option for Limited companies looking for an alternative to the individual income protection policy.

Pension Review

If you already have an existing Executive Pension plan in place you need to ensure that:

- Your Pension Plan is being funded directly through the company.

- Your plan charges are transparent and cost-efficient.

- The Risk Profile of the fund and the underlying investments is in line with YOUR attitude to risk.

As Pension Brokers, we provide unbiased advice and compare the market for the most competitive products and offer a range of investment fund options.

The rules governing overall contributions to Executive Pensions can be complex. We recommend that you seek advice from a Financial Advisor first to make sure the company pension is set up correctly, and to maximize the overall contributions and tax-efficiency.

Letter of Authority:

In order for our Financial Advisors to review your pension benefits and advise on your options, complete the below form (using the “download” link) and send this to info@smartfinancial.ie.

In addition, make sure to submit your enquiry in the field below…

Need to speak with a Financial Advisor?

Fill out your details and enquiry below, and one of our Qualified Financial Advisors will get back to you shortly.

One thought on “Directors Pension Ireland”